G/L Triggers -G/L Reallocation Recoup Audit Fees

G/L Reallocation : A Group of companies using Inter-Entity wants to recover audit fees incurred by one Group Company on behalf of other Group Companies through raising an expense and income entry, not just an expense entry.

AP Invoice entered for audit fees in Entity 1. A portion of the audit fees belongs to Entity 5. IY G/L Triggers automatically raise a G/L Reallocation to show the audit fees recovered from Entity 5.

The configuration results in showing Revenue Recoverable & Allocated Expense separately.

Requirement! This uses Inter-Entity Transactions Trigger functionality. It is available in Inter-Entity Transactions Single Company and Multi-database, but G/L Reallocation only works within the same Sage 300 company.

The entry we want to process

We will enter an A/P Invoice for $700 - $400 to an expense account for Entity 1, and $300 for an expense account for Entity 5.

| 7601-1 Audit Fee Expense - 1 | ||||||

|

| 7605-1 Audit Fee - Entity 5 | |||||||

|

| AP Vendor Control Account | ||||||

|

IET Triggers will create the G/L Reallocation entries and Inter-Entity Transactions will create loan account entries as below so that the entries are balanced within Entity 1 and Entity 5.

| 8000-5 Audit Fees (Entity 5) | ||||||

|

| 4999-1 Audit Fees recoverable (Entity 1) | |||||||

|

| Due From Entity 5 (-1 asset) | ||||||

|

| Due to Entity 1 (-5 liability account) | |||||||

|

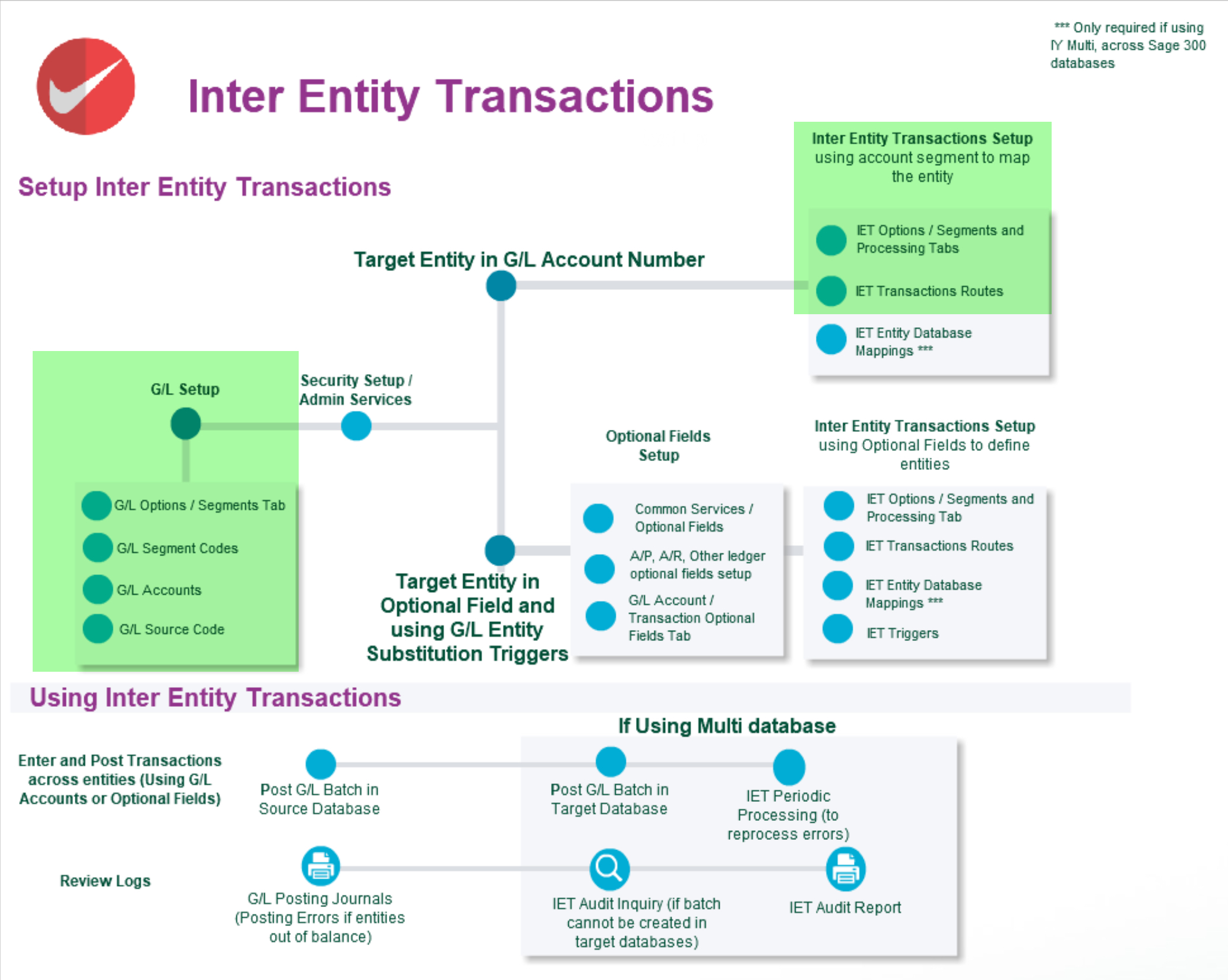

Visual process flow for setup

General Ledger Setup

This has been done in the ORCLTD database in Orchid Sample data.

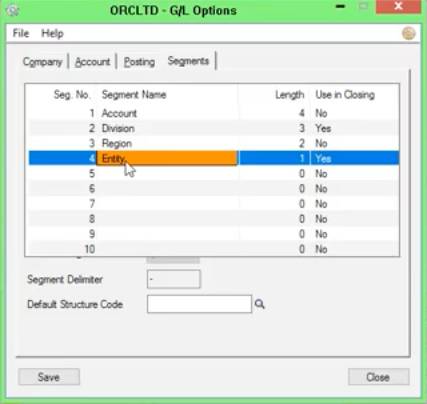

Create a G/L segment to define the entity

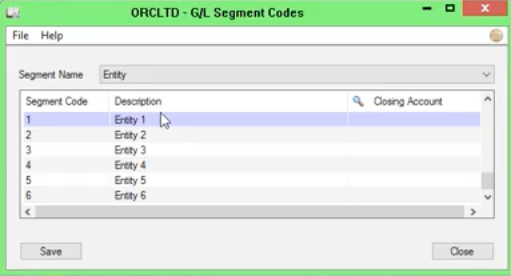

Setting up the entities in G/L > Segment Codes

Set up the expense and loan accounts in G/L

The A/P Control account for the Vendor used for the recording of the audit fee expenses must belong to the same entity as the G/L Trigger account, in this example, Entity 1

In this example, loan accounts as per the IET Tutorial. (Due to 5 and Due from 5, Due to 1 and Due from 1 )

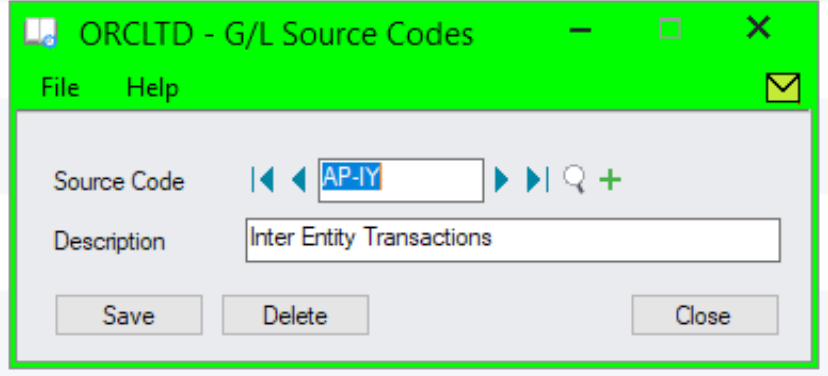

Set up the source codes in G/L

In this tutorial, AP-IY and AP-IT for G/L Trigger entries will be used for transactions generated by Inter-Entity Transactions.

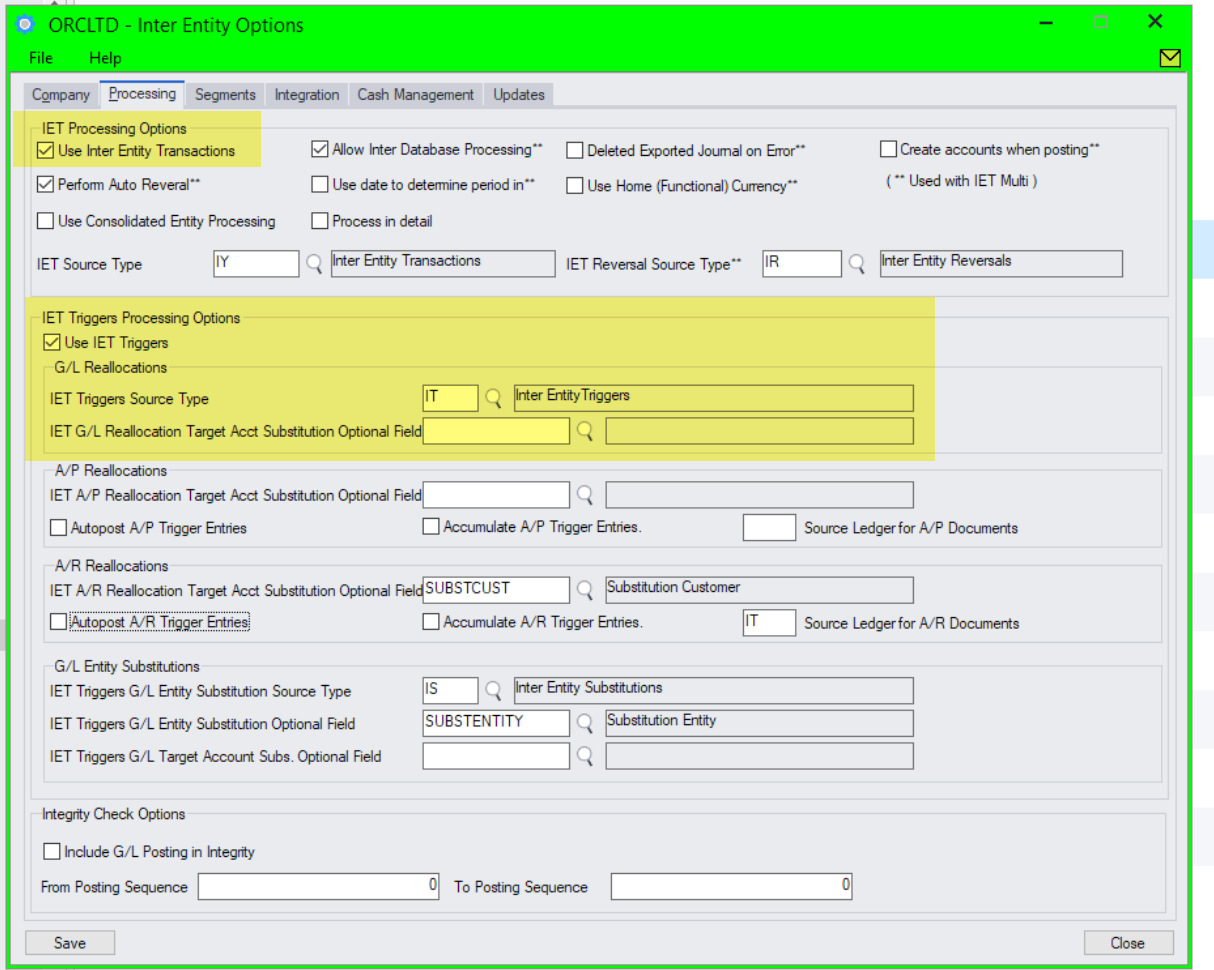

Inter-Entity Options Setup

For details on each option, refer to the detailed screen guide. Inter-Entity Options Screen Guide and Field List.

Setup Inter-Entity Processing as per the Automate Loan Accounts tutorial. Automate Loan Account Entries - IY Single Database Tutorial

Setup Inter-Entity Options

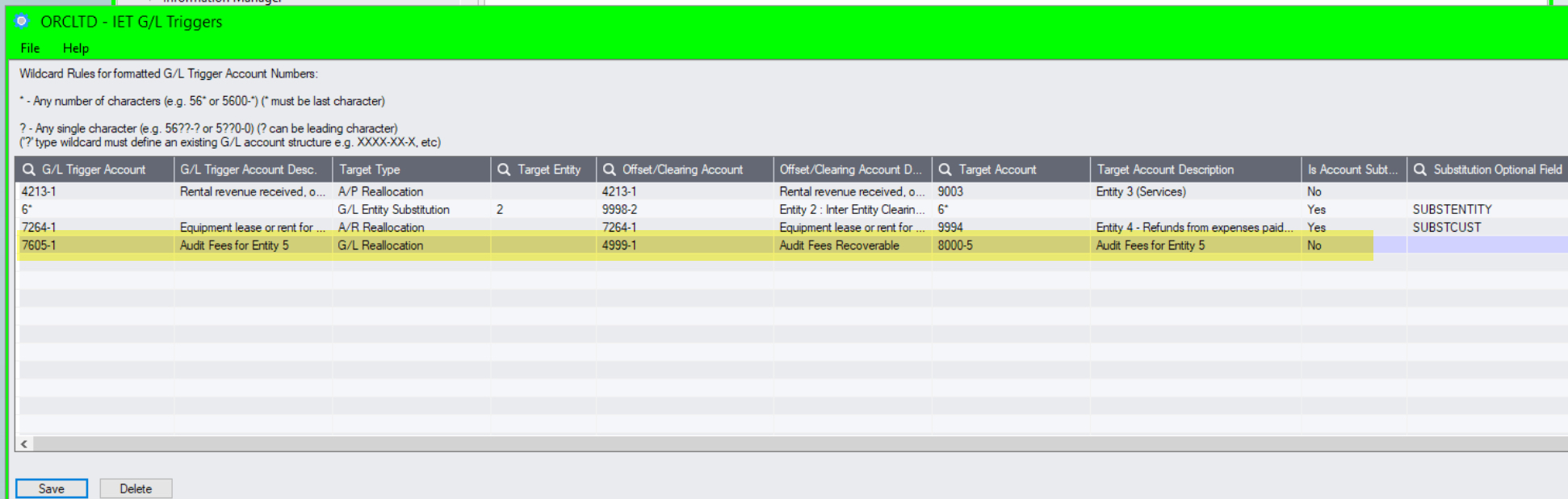

Setup G/L Triggers - G/L Reallocations

If the requirement is to always re-allocated balances in the G/L Account 7605-1 to the G/L Account 8000-5, then you do not need to check "is account Substitutable" or fill in the "substitution optional field".

If you need to record the required target G/L Account on the source sub-ledger transaction data entry - in an optional field, then you can configure "Yes" to "Is Account Substitutable", provide the optional field name that will be used to enter the G/L Account on the sub-ledger transaction. This Optional field needs to be captured in the sub-ledger source transaction entry, and then flowed through to the General Ledger at a transaction level in order for G/L Triggers to act on the optional field.

Process a transaction

(1) Initial Entry : AP Invoice to record Audit Fee Expense

(1) Resulting G/L Batch

(2) G/L Reallocation created when G/L Batch is posted because 5000-1 has been specified as a trigger account

(3) IET Balancing entries created when G/L Batch is posted - because Entry out of balance between Entity 5 & Entity 1

Tip: You can use a similar scenario with entities in separate Sage 300 databases using Inter-Entity Multi-database.