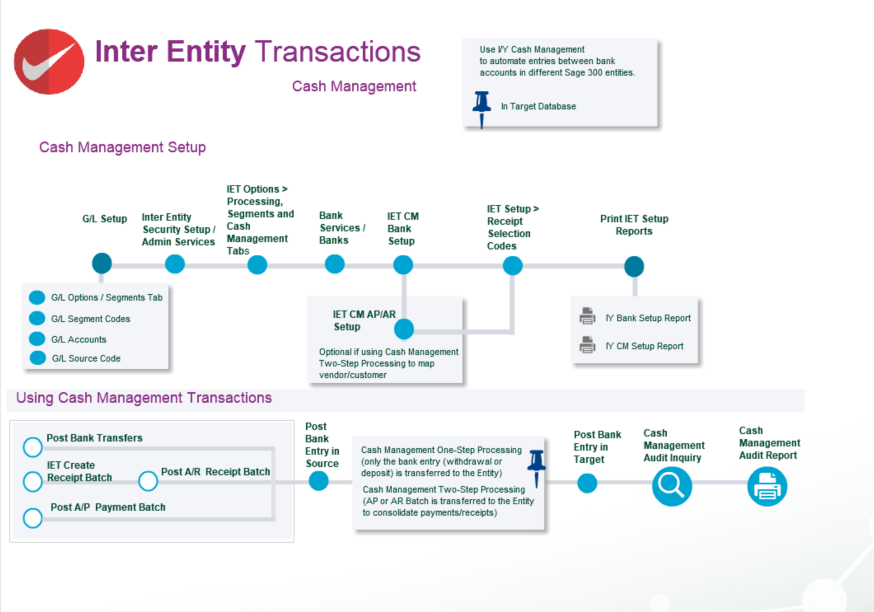

Cash Management 1-step Tutorial: Payments/Receipts from another Company's Bank Account

Using IET Cash Management, you are able to process receipts and payments in the source company (for example SAMLTD), but the bank entry is processed in the target company (for example SAMINC).

In order to achieve this : in the source company configure a Cash Management Bank Account to represent the actual bank account in the target company.

Requirement! Inter-Entity Transactions Multi Edition

Cash Management Setup

In the source company, create the following accounts (SAMLTD in the example below)

1001-1 SAMINC Bank Clearing account

In the source company, create the following bank account (SAMLTD in the example below)

Ensure the G/L Accounts belong to the source entity

In the source company, create the following IET Cash Management Bank (SAMLTD in the example below)

Process Payment/Receipt in Source

Process the required Payments/Receipts in the source company (SAMLTD)

Using AP Payments as an example, process the required AP Payment batch :

Post Payments/Receipts

When posted, the payment records are recorded in the Inter-Entity Inter-Entity (Cash Management) Audit log

and Bank Entries recorded in SAMLTD to reverse the payment from the dummy bank account (via the loan account entries set up in IET Routes)

and Bank Entries recorded in SAMINC to record the payment from the bank account (via the loan account entries set up in IET Routes)